No one should need to worry about money after a lifetime of contributions to our society. Yet, across the country, many older Canadians are facing a precarious future of poverty having outlived their savings because the rules around retirement savings are outdated, companies are not required to protect pensioners, and incidents of elder abuse are skyrocketing.

Ageism in the workplace is still too common, with the precedent of old mandatory retirement laws and prejudices toward seniors in the workplace is a stark reality. Canada needs to enable our aging population by making workplaces more age-friendly and accessible, while also providing greater security for those who choose to retire. We must also provide seniors the financial freedom to make necessary home modifications which allow them to age in place – the preferred housing option for most older Canadians.

The problem

The number of low-income seniors is increasing in Canada, and so too is the risk of poverty and being unable to afford basic necessities. Cost of living has increased, pensions are at risk and seniors are living longer which means stretching their funds further and thinner. Our systems are not adequate for providing seniors the financial security in retirement that they deserve.

Seniors need the freedom to continue to work, but may face barriers of prejudice for which our society needs to adapt. Banking institutions should also adapt and be more responsive to the increased prevalence of financial abuse, fraud and scams that commonly target seniors.

Our solution

We’re asking all federal parties to protect the economic wellbeing of people 50+ by ensuring pensioners are protected from unfair bankruptcy laws, that employers do not discriminate against older workers, and to end mandatory RRIF withdrawals at 71.

Our federal leaders must also commit to real financial support for caregivers and home modifications to allow Canadians to age safely in place.

- Pensions matter

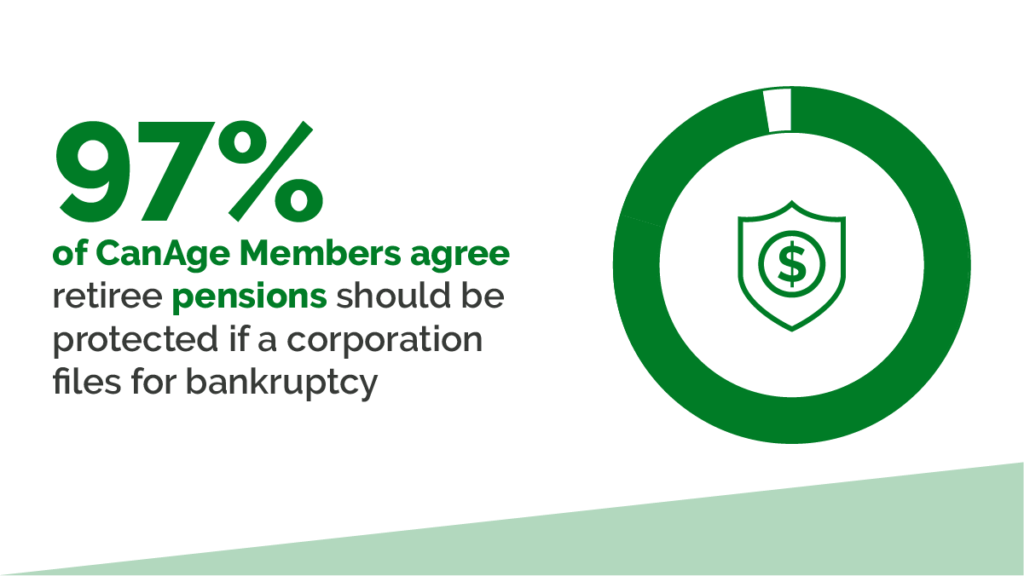

Put pensioners first in line to get their own deferred wages before payouts to CEOs and corporate creditors. Create Pension Benefit Guarantee Funds and require pension funds to be fully funded to 100%. - Financial Protections matter

Banks and financial advisors update Know Your Client (KYC) protocols to ensure that they can include asking for a Trusted Contact Person. Ensure workers in the financial sector have competency-based training on elder abuse, mental capacity issues, undue influence and how to report concerns. Make strides to increase the accessibility of tax filing for seniors with prompts for tax relief benefits and a pilot program for automatic tax filing. - Control of Your Own Savings matters

Mandatory RRIF withdrawals at age 71 made sense when RRIFs were created – as the average age of death was 74. Seniors now can expect to live well into our 80s or more. Seniors need the flexibility to control their own retirement savings to stretch out over decades. We must get rid of mandatory RRIF withdrawals and give Canadians back the right to plan their own financial retirement plan.

Our Members have spoken

We surveyed our members to get their opinions on this issue. Here’s what they had to say.